BVCU Gold

Ready to Buy?

Silver Gold Bull offers a full compliment of services to fulfill your precious metals investing needs with industry leading rates!

Bow Valley Credit Union has the Credit Union Deposit Guarantee Corporation’s unlimited 100% guarantee of your deposits.

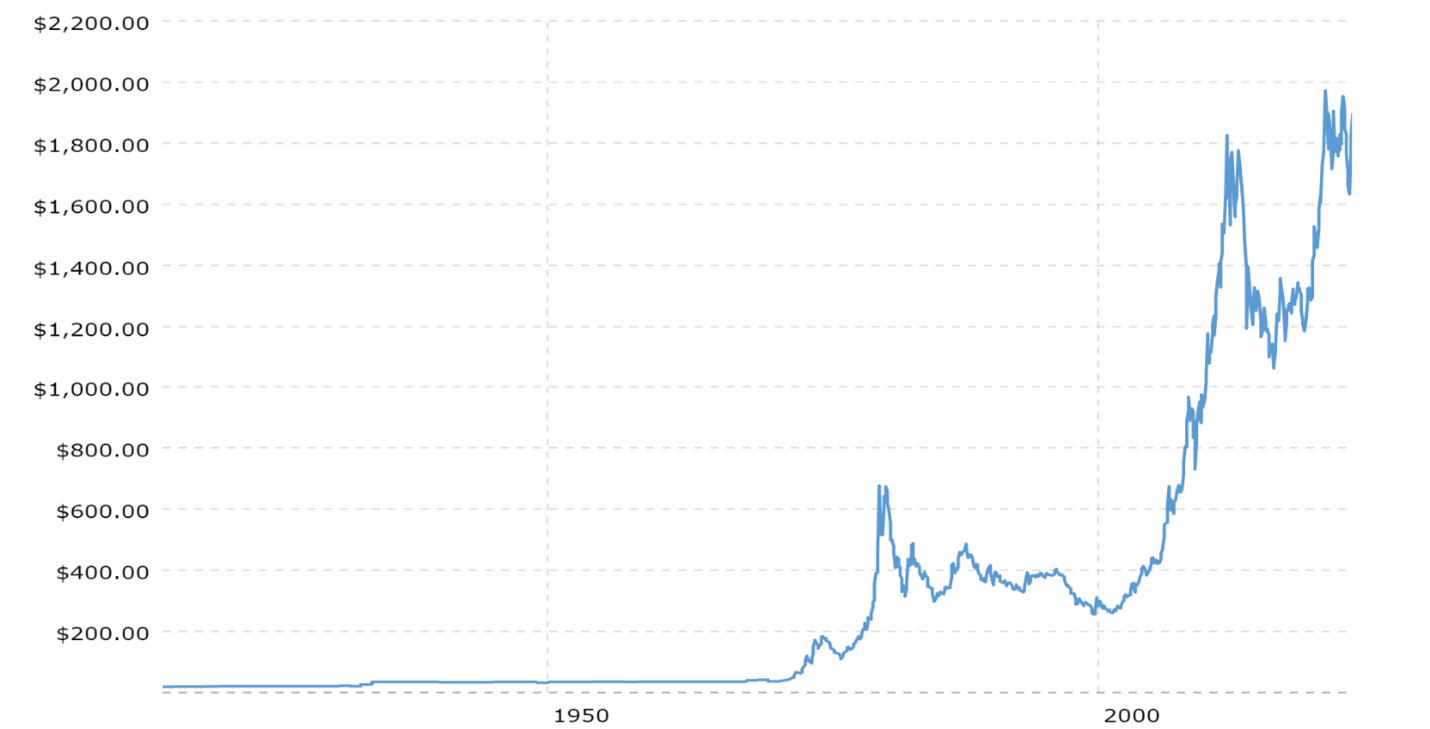

As part of any diversified financial portfolio strategy, people should consider gold, silver, or any other precious metals as part of their strategy, as Bow Valley Credit Union has.

FAQ

FAQ

PART I: ABOUT BVCU GOLD

From time to time, the gold and other precious metals will be audited by our external third-party auditors for our year-end financial statements.

Unfortunately, no. Organizationally, we are not set up to be able to provide this service; however, this service would likely go hand in hand with selling gold or silver to members, if pursued in the future.

The intention is for the gold to work just like an insurance policy and to only use it, when necessary, for example, in the unlikely situation of a liquidity or capital event.

PART II: BECOMING A MEMBER & ABOUT BVCU

- Banff

- Canmore

- Cochrane

- Airdrie (Cooper’s Town)

- Airdrie (Kingsview)

- Calgary (Sage Hill)

Our branches work together to ensure our members-first vision of banking.

If you’re a resident of Alberta and would like to open a personal account, you can join today through our online application process for personal members! To become a member, a $25 Common Share requirement is needed plus an additional deposit to open your account; you are now a member! A Member Card would be mailed directly to you, with a pin a few days later. You are now set up to use online banking and do day-to-day transactions; between online, mobile, and connecting directly with the branch, there's not much you can't do from anywhere at any time! Your Member Card can be used at any Canadian credit union ATM for free.

Unfortunately, we aren't currently capable of opening business accounts online (coming soon!); however, we can assist you remotely.

This process can be started by gathering information through email directly with a branch. There may be a requirement for you to attend the branch.

If you would prefer to open your account in branch and for Business members, you will need to select a branch to assist you (Banff, Canmore, Cochrane, Airdrie Cooper’s Town, Airdrie Kingsview, or Calgary Sage Hill).

We are currently experiencing higher than normal volumes but are looking forward to meeting and assisting you as soon as we can! Book a time for us to connect directly with your preferred branch.

PART III: BVCU'S DIRECTION

BVCU does not believe in this approach and won’t willingly subscribe to any elements of banking that would make this possible, including Open Banking, Digital IDs, or CBDCs (Central Bank Digital Currencies), unless forced to by law.

As a credit union we are focused on Data Privacy, Board Diversity, and Employee Engagement, which are elements of ESG. Beyond this, we have no plans to further integrate ESG into our organization, unless forced to by law.

To summarize, our main investment is loans to members, including residential mortgages, consumer loans, and commercial loans.

BVCU does a significant amount of real estate lending, through both residential mortgage lending and commercial lending around real estate development and construction. Additionally, we invest funds into term deposits with Credit Union Central of Alberta. With respect to Physical precious metals, their value is held off-balance sheet because we are only able to recognize the "face value" of our precious metals.

BVCU is supportive of the O&G industry, as that industry is at the heart of the Alberta economy. Currently, we aren’t in the oil and gas industry space.

Search

Search

www.google.com

www.google.com